Working Papers

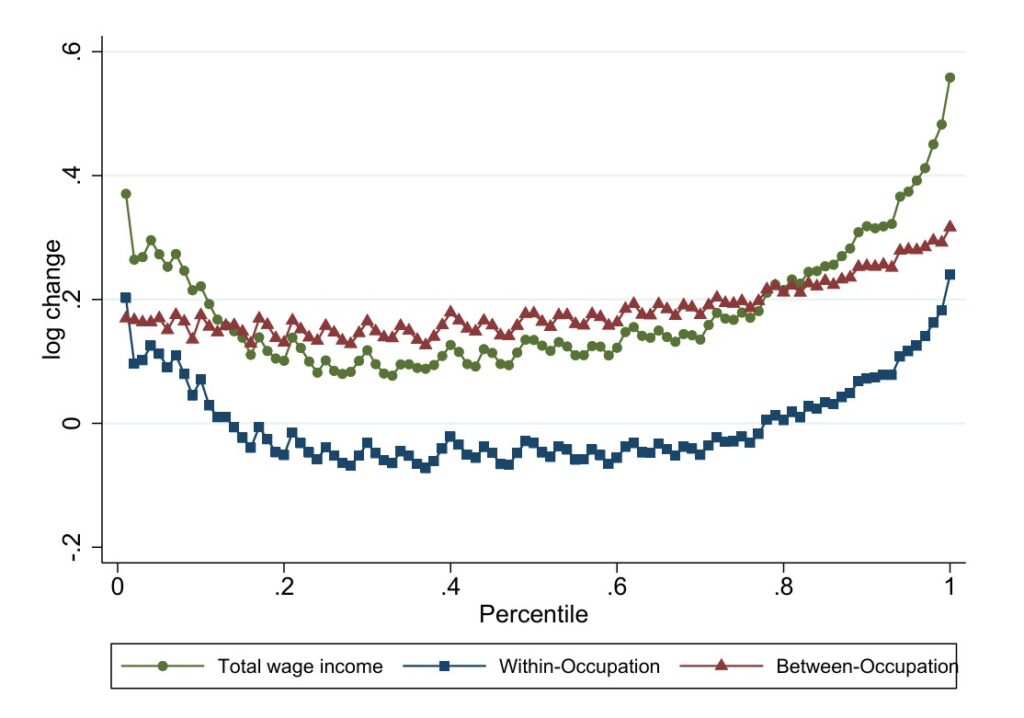

“The Spillover Effects of Top Income Inequality“, with Josh Gottlieb, Jeff Hicks and David Hemous, 2025 (2nd Revision requested ECMA)

Abstract

“Top income inequality in the United States has increased considerably within many occupations. This phenomenon has led to a search for a common explanation. We instead develop a theory where increases in income inequality originating within a few occupations can “spill over” through consumption into others. We show theoretically that such spillovers occur when an occupation provides non-divisible services of heterogeneous quality to consumers. Examining local income inequality across U.S. regions, we find evidence that such spillovers exist for physicians, dentists, other medical occupations, and real estate agents. Estimated spillovers for other occupations are consistent with the predictions of our theory. Calibrating our model, we show that spillovers amplify a given shock to top income inequality by at least 16%. Spillovers dampen the increase in consumers’ welfare inequality compared with the change in income inequality”

Figure: Change along the income distribution (1980 – 2012)

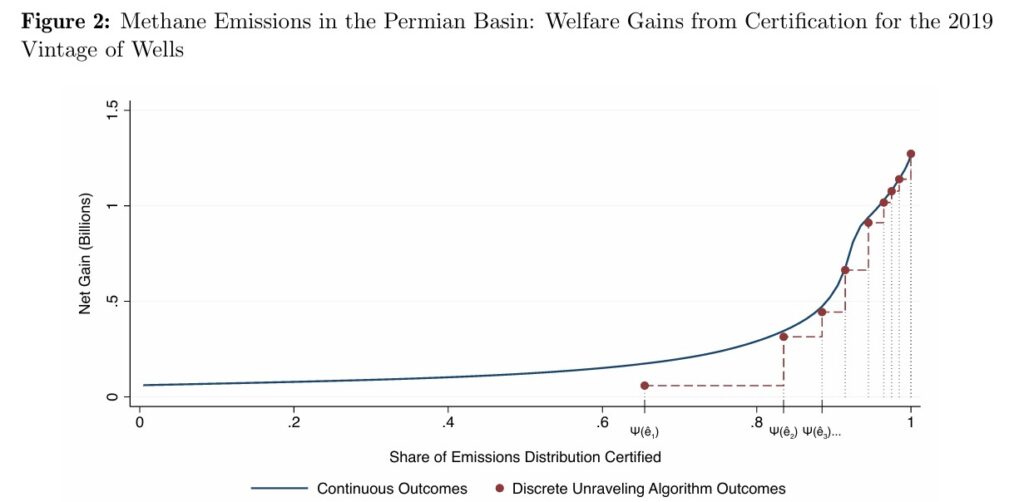

“Advantageous Selection as a Policy Instrument: Unraveling Climate Change“, with Steve Cicala and David Hemous, 2023 (Revision requested AER)

Abstract

“This paper applies principles of adverse selection to overcome obstacles that prevent the implementation of Pigouvian policies to internalize externalities. Focusing on negative externalities from production (such as pollution), we consider settings in which aggregate emissions are known, but individual contributions are unobserved by the government. We evaluate a policy that gives firms the option to pay a tax on their voluntarily and verifiably disclosed emissions, or pay an output tax based on the average rate of emissions among the undisclosed firms. The certification of relatively clean firms raises the output-based tax, setting off a process of unraveling in favor of disclosure. We derive sufficient statistics formulas to calculate the welfare of such a program relative to mandatory output or emissions taxes. We find that the voluntary certification mechanism would deliver significant gains over output-based taxation in two empirical applications: methane emissions from oil and gas fields, and carbon emissions from imported steel.”

“The Firms behind the Labor Share: Evidence from Danish Micro data“, with David Hemous, 2022

Abstract

We establish a sizable shift in the individual labor shares of Danish firms since. Whereas the mean and median labor shares have increased by around 5 points, the labor share of the largest firms is much lower today, in particular the labor share of manual workers. A substantial part of this is driven by the top 1 per cent of firms that have grown substantially bigger. The main driver of this is an increase in markups, though large rms have become more capital intensive during the period. We show that investments in capital and R&D predict declines in the labor share. Though o shoring activities have impacted the labor share it is not a strong quantitative driver of the results. We show that these changes tie strongly to the rms export behavior: Large rms with lower labor share scale up value of exports, though not number of destinations nor product category. The increase in value comes predominantly from increases in quantity.

“Medicare and the Rise of American Medical Patenting: The Economics of User-Driven Innovation”, with Jeff Clemens, 2022

Abstract

Innovation is part idea generation and part development. We build a model of “innovating-bydoing,” whereby ideas come to practitioners. Successful innovation requires that practitioners’ ideas be developed through costly effort. Our model nests existing theories of laboratory research and learning-by-doing. Empirically, we analyze the effect of the U.S. Medicare program on medical equipment innovation. Our model’s structure allows us to infer the Medicare program’s aggregate effects. We estimate that Medicare’s introduction led to a 20 to 30 percent increase in medical equipment patenting across the United States, of which roughly half is due to the innovating-by-doing channel.

Published Papers

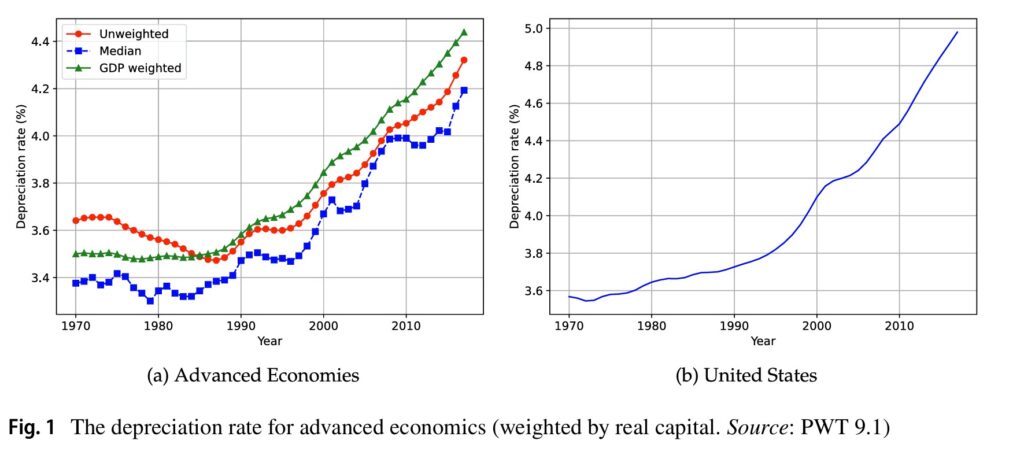

“Has the Real Rate of Return ‘Depreciated’?“, With Carl-Johan Dalgaard, Journal of Economic Growth, 2025

Abstract

The average depreciation rate in the United States has increased since the 1970s, a pattern most likely matched in other advanced economies. We argue that a higher depreciation rate has reduced the risk-free interest rate. We do so in a quantitative overlapping-generations model which allows for risk-premia and market power. We show that the importance of the rate of depreciation on the risk-free interest rate depends crucially on the elasticity of intertemporal substitution as well as the size of market power. Our calibrated model shows that higher depreciation plausibly reduced the risk-free rate by 30 basis points over the past half century. We contrast our results with models using a representative-agent framework (Farhi and Gourio in Accounting for macro-finance trends: market power, intangibles, and risk premia. Brookings papers on economic activity, 147, 2019) which typically do not find a role for the rate of depreciation.

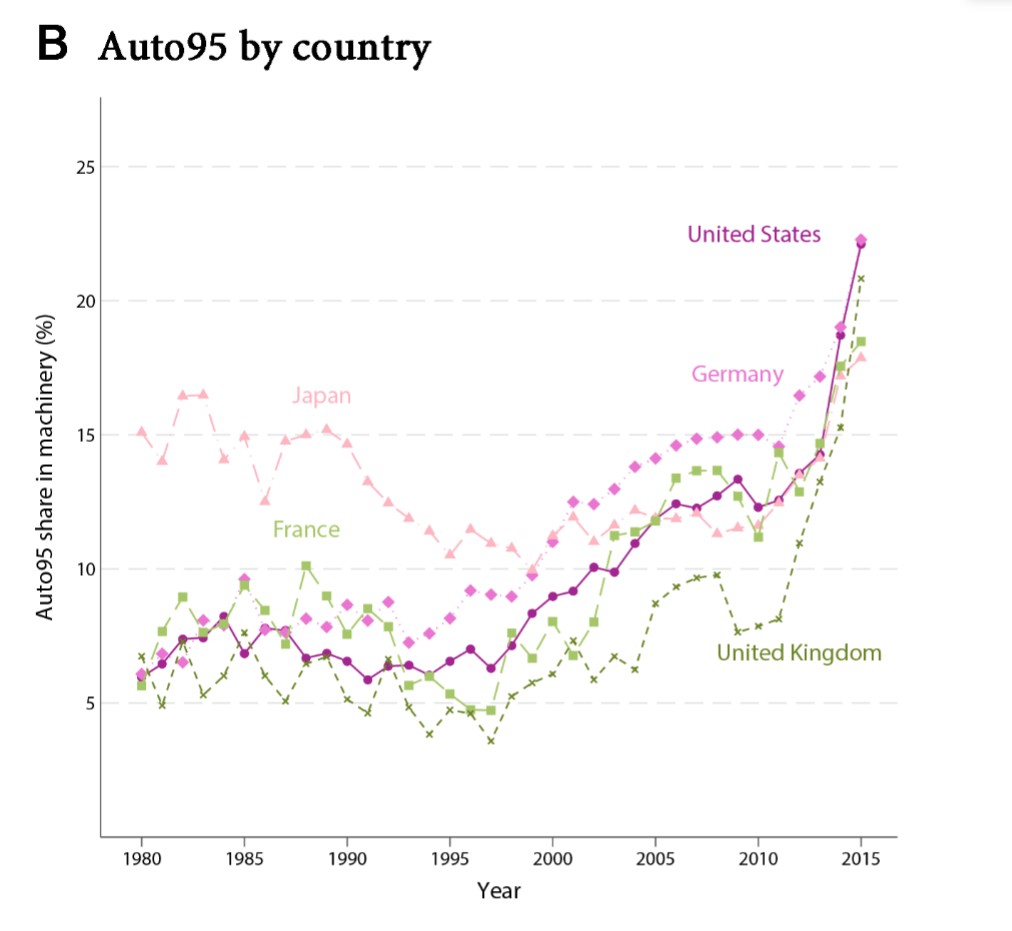

“Induced Automation Innovation: Evidence from Firm-Level Patent Data”, with David Hemous, Carlo Zanella and Antoine Dechezlepretre, Journal of Political Economy, 2025

Abstract

Do higher wages induce more automation innovation? We identify automation patents in machinery. We show that a higher automation intensity predicts a decline in routine tasks across US sectors. Then, we estimate how innovating firms respond to changes in their downstream firms’ low- and high-skill wages. We compute these wages by combining macro-economic data on 41 countries with innovating firms’ global market ex-posure. Higher low-skill wages increase automation innovation (but notother machinery innovation), with an elasticity of 2–5. Finally, we show that the German Hartz labor market reforms reduced automation innovations by foreign firms more exposed to Germany.

Figure: Share of Automation Patents in Machinery

“The Rise of the Machines: Automation, Horizontal Innovation, and Income Inequality“, with David Hemous, AEJ Macro 2022 (Best Paper Award) Appendix

Abstract

We build an endogenous growth model with automation (the replacement of low-skill workers with machines) and horizontal innovation (the creation of new products). Over time, the share of automation innovations endogenously increases through an increase in low-skill wages, leading to an increase in the skill premium and a decline in the labor share. We calibrate the model to the US economy and show that it quantitatively replicates the paths of the skill premium, the labor share, and labor productivity. Our model offers a new perspective on recent trends in the income distribution by showing that they can be explained endogenously.

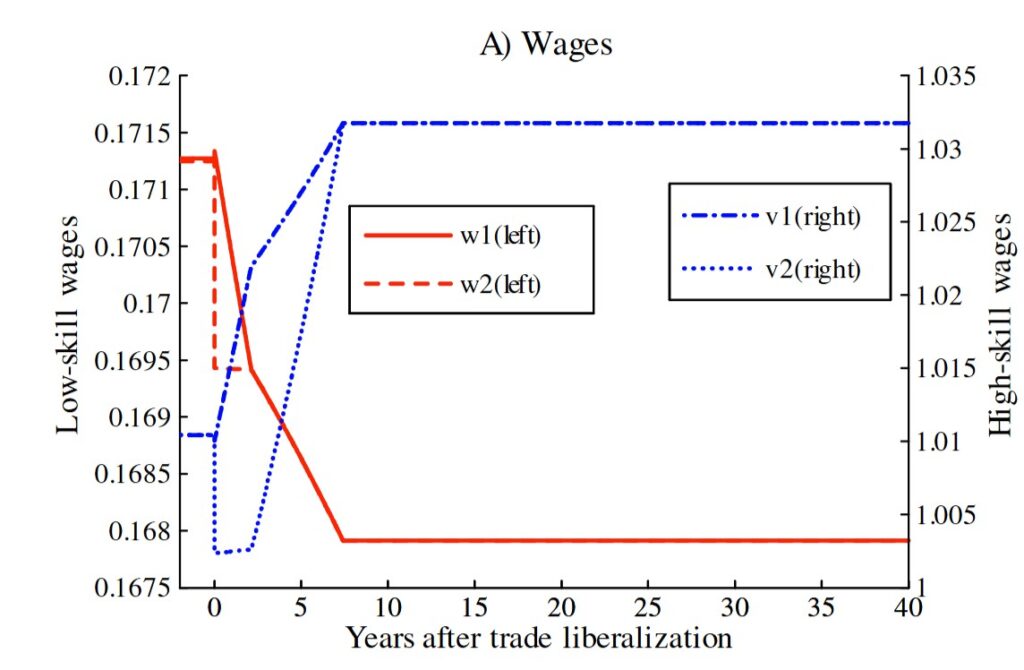

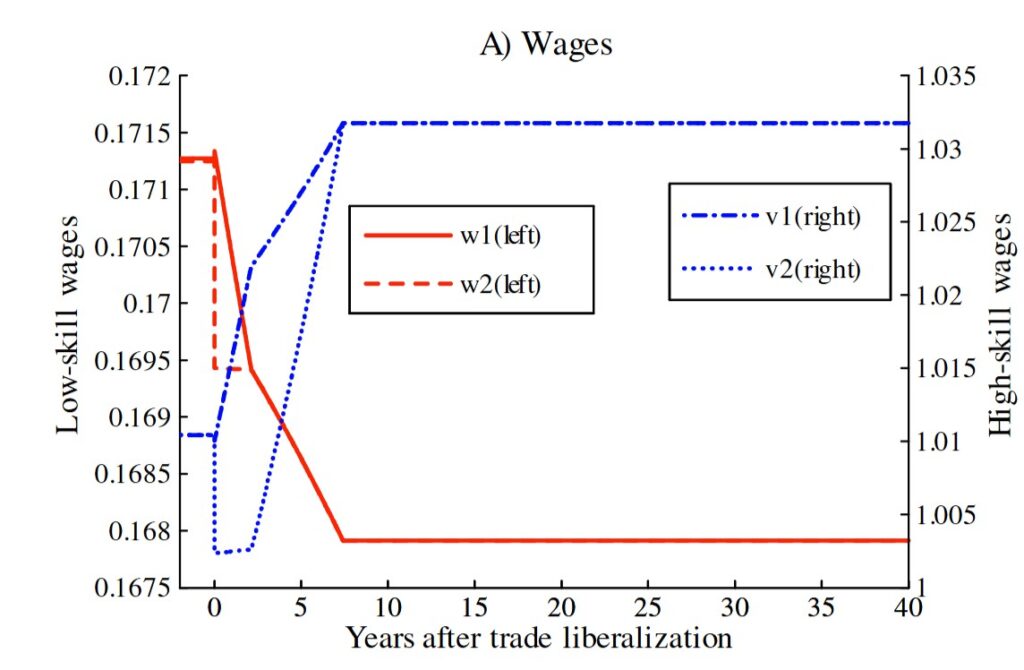

“Trade Dynamics with Sector-Specific Human Capital”, with Adam Guren and David Hemous, Journal of International Economics 2015

Abstract

This paper develops a dynamic Heckscher Ohlin Samuelson model with sector-specific human capital and overlapping generations to characterize the dynamics and welfare implications of gradual labor market adjustment to trade. Our model is tractable enough to yield sharp analytic results, that complement and clarify an emerging empirical literature on labor market adjustment to trade. Existing generations that have accumulated specific human capital in one sector can switch sectors when the economy is hit by a trade shock. Nonetheless, the

shock induces few workers to switch, generating a protracted adjustment that operates largely through the entry of new generations. This results in wages being tied to the sector of employment in the short-run but to the skill type in the long-run. Relative to a world with general human capital, welfare is improved for the skill group whose type-intensive sector shrinks. We extend the model to include physical capital and show that the transition is longer when capital is mobile. We also introduce nonpecuniary sector preferences and show that larger gross flows are associated with a longer transition.

“Directed Technical Change in Labor and Environmental Economics”, with David Hemous, Annual Reviews, 2021

Abstract

It is increasingly evident that the direction of technological change responds to economic incentives. We review the literature on directed technical change in the context of environmental economics and labor economics, and we show that these fields have much in common both theoretically and empirically. We emphasize the importance of a balanced growth path and show that the lack of such a path is closely related to the slow development of green technologies in environmental economics and to growing inequality in labor economics.We discuss whether the direction of innovation is efficient.

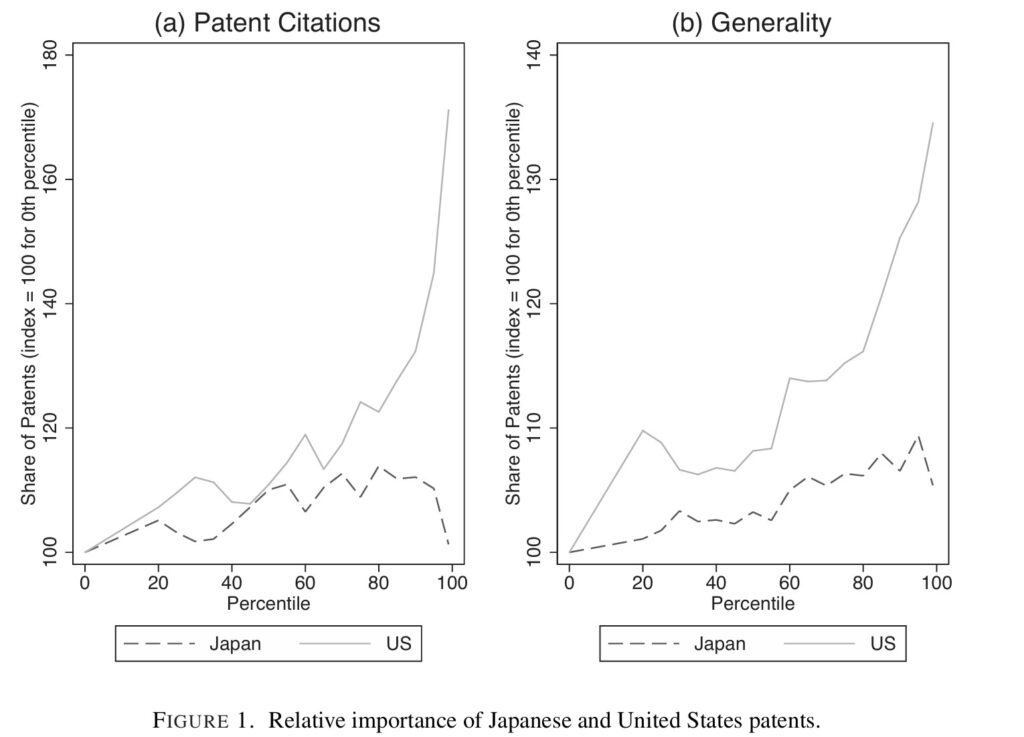

“Long-term Relationships: Static Gains and Dynamic Inefficiencies,” with David Hemous, Journal of European Economic Association, 2017

Abstract

In the 1980s the Japanese “keiretsu” system of interconnected business groups was praised as a model to emulate, but since then Japan has often been criticized for being less innovative than the United States. In this paper we connect the two views and argue that tight business relationships can create dynamic inefficiencies and reduce broad innovations. In particular, we consider the repeated interaction between final good producers and intermediate input suppliers, where the provision of the

intermediate input is noncontractible. We build a cooperative equilibrium where producers can switch suppliers and start cooperation immediately with new suppliers. We first consider broad innovations: every period, one supplier has the opportunity to create a higher quality input that can be used by all producers. Since relationships are harder to break in the cooperative equilibrium the market size for potential innovators is smaller and the rate of innovation might be lower than in the noncooperative equilibrium. We contrast this with a setting with relationship-specific innovations that we show are encouraged by the establishment of relational contracts. We illustrate the predictions of the model using the recent business history of the United States and Japan and further use patent data to show that U.S. patents are more general than Japanese and even more so in sectors using more differentiated inputs.

“Trade Dynamics with Sector-Specific Human Capital“, with Adam Guren and David Hemous, Journal of International Economics, 2015

Abstract

This paper develops a dynamic Heckscher Ohlin Samuelson model with sector-specific human capital and overlapping generations to characterize the dynamics and welfare implications of gradual labor market adjustment to trade. Our model is tractable enough to yield sharp analytic results, that complement and clarify an emerging empirical literature on labor market adjustment to trade. Existing generations that have accumulated specific human capital in one sector can switch sectors when the economy is hit by a trade shock. Nonetheless, the shock induces few workers to switch, generating a protracted adjustment that operates largely through the entry of new generations. This results in wages being tied to the sector of employment in the short-run but to the skill type in the long-run. Relative to a world with general human capital, welfare is improved for the skill group whose type intensive sector shrinks. We extend the model to include physical capital and show that the transition is longer when capital is mobile. We also introduce nonpecuniary sector preferences and show that larger gross flows are associated with a longer transition.